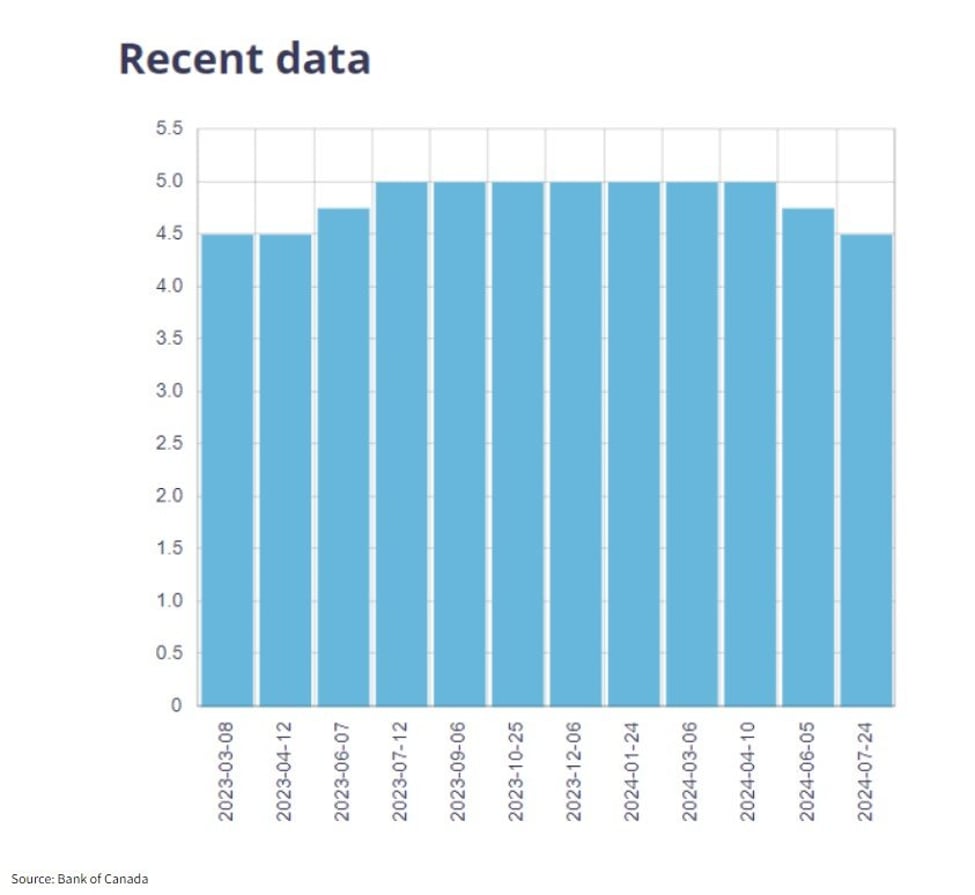

The Bank of Canada’s recent announcement of yet another interest rate cut is likely music to the ears of many Canadian homebuyers and homeowners. On July 24, the central bank revealed it would lower its key interest rate from 4.75% to 4.5%, following a lot of chatter that began earlier in the month after inflation data showed consumer prices weren’t rising as quickly as expected.

The last time the rate was cut, we saw a bit of a bump in the real estate market. The Canadian Real Estate Association (CREA) reported a 3.7% increase in home sales in June compared to May—a clear sign that the lower rates nudged some people off the fence and into action. CREA’s Senior Economist, Shaun Cathcart, mentioned that while the increase isn’t groundbreaking, it’s a shift that suggests something is happening.

With mortgage payments directly tied to interest rates, it’s no wonder homeowners, buyers, and sellers are paying close attention. If rates drop again, it could boost confidence even more, leading to more buying and selling activity. But are you ready to dive in? That’s where a good REALTOR® becomes invaluable. Here’s why:

1. Market Insights

Canadians are eager to jump back into the market, and with demand building up, we might see more bidding wars, homes selling above the asking price, and busy open houses. Your REALTOR® has access to local market data and the experience to navigate these fast-moving situations. They can handle the details—like setting up showings, managing offers, and negotiating prices—so you don’t have to stress.

Whether you’re selling or buying, your REALTOR® can provide you with crucial information. They can tell you what similar homes in your area are sold for, or they can use tools like the MLS® Home Price Index to give you a clear picture of local trends. They also know what buyers are looking for and can help you figure out if your home fits the bill.

2. Negotiation Skills

Interest rates may go up or down, but one thing remains the same: your REALTOR® is there to get you the best deal possible. They’ll take into account your budget and financial situation to negotiate a price that works for you. Some REALTORS® have extra training in negotiation, so if that’s something you value, it’s worth seeking out someone with those credentials.

3. Financial Guidance

Even before you’re pre-approved for a mortgage, your REALTOR® can help you get a handle on your financial situation. With interest rates dropping, now might be the time to act. Your REALTOR® can recommend trusted lenders and offer advice on how to secure the best rate. Tools like the REALTOR.ca Affordability Calculator and Payment Calculator can also give you a snapshot of what you can afford.

4. Professionalism and Security

Real estate transactions are complicated, and it’s easy to feel overwhelmed by all the variables—especially when interest rates are fluctuating. A good REALTOR® will guide you through the process, from understanding legal fees to timing your sale or purchase just right. They’ll make sure you feel confident every step of the way.

5. Your Real Estate Guide & Expert

Think of your REALTOR® as your go-to person in the real estate world. While you’re figuring out your finances, they’re busy behind the scenes—setting up property searches, attending open houses, and getting your home ready for sale. Their hard work can give you an edge in a competitive market.

Our Team Leader, Tony Alushi, is a Certified Real Estate Negotiation Expert, Accredited Buyer Representative, and Seller Representative Specialist. Take advantage of his credentials to get the best deal in buying or selling your home!"

Call Us Today at 647.493.357 & Start Packing.

In a market shaped by changing interest rates, having a knowledgeable REALTOR® by your side makes all the difference. They stay on top of trends and data, so whether you’re buying or selling, you can confidently make informed decisions.

References:

Source: Realtor.ca ,Matt Day 07/24/24

Source: Bank of Canada

.png)