3. Upgrading to a New Home Becomes More Affordable

If you're thinking about selling your current home to buy a new one, lower mortgage rates mean you could upgrade to a larger or more desirable property without a significant increase in your monthly payments. This creates a great opportunity for sellers looking to make a move.

How This Rate Cut Affects Homeowners Considering Refinancing

1. Potential for Lower Monthly Payments

For homeowners with variable-rate mortgages, this rate cut may result in lower monthly mortgage payments immediately. Those with fixed-rate mortgages may want to consider refinancing to lock in a lower rate and save money on interest over time.

2. Accessing Home Equity for Investments or Renovations

A lower interest rate makes refinancing more attractive for those looking to access home equity. Whether it’s for home renovations, debt consolidation, or investing in additional properties, refinancing at a lower rate can be a strategic financial move.

3. Timing Matters – Rates May Not Stay Low Forever

While the Bank of Canada has cut rates, future changes remain uncertain. If you’re considering refinancing, it’s wise to act while rates are low and before potential future increases. Consulting with a mortgage professional can help you determine the best strategy for your financial situation.

What’s Next? Should You Buy, Sell, or Refinance Now?

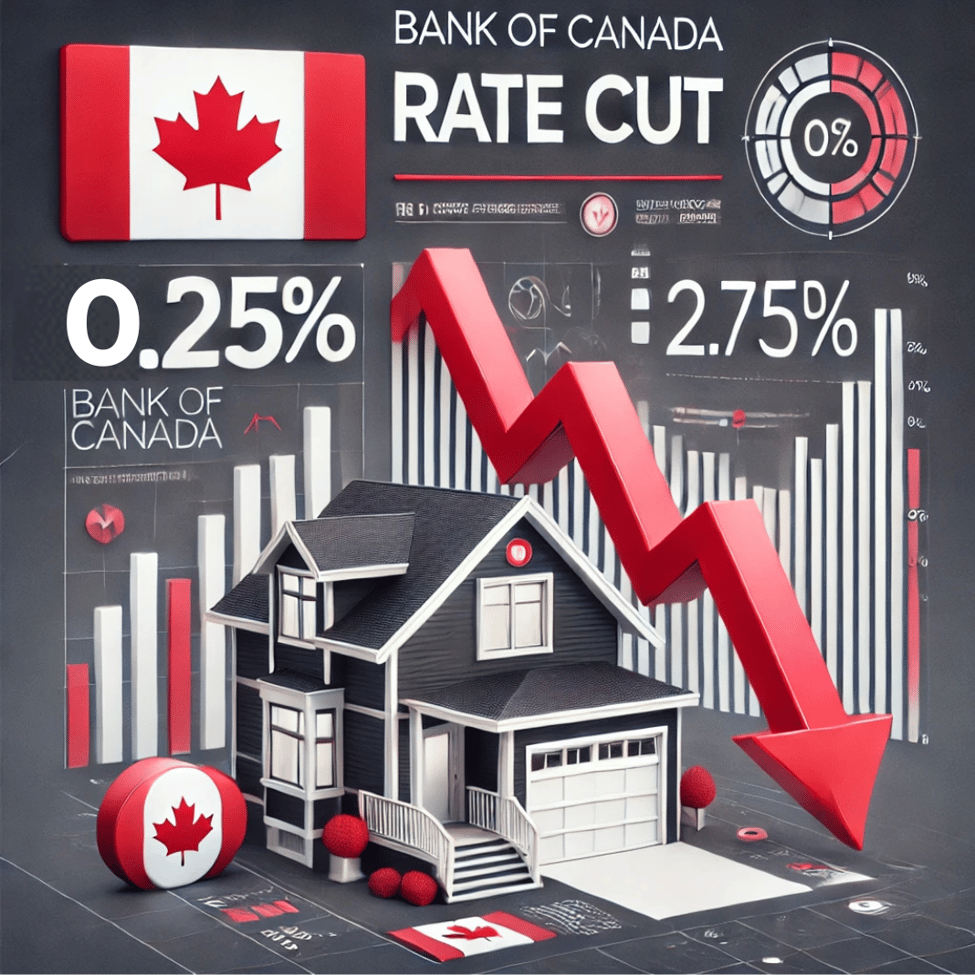

This 0.25% rate cut opens up opportunities for homebuyers, sellers, and homeowners. However, every real estate decision should be made based on your personal financial situation, market conditions, and long-term goals.

🔹 If you’re a buyer, getting pre-approved and acting fast before competition drives up prices could be a smart move.

🔹 If you’re a seller, leveraging the increased buyer demand to sell your home quickly and at a great price could work in your favor.

🔹 If you’re a homeowner, exploring refinancing options might save you thousands over the life of your mortgage.

Final Thoughts

Interest rate cuts create a ripple effect in the housing market, affecting affordability, competition, and home values. Whether you’re buying, selling, or refinancing, understanding how these changes impact you is key to making the right financial move.

📩 Need expert advice on navigating the real estate market in light of this rate cut? Reach out to a trusted real estate professional to discuss your options and make informed decisions that align with your goals

Take Advantage of Lower Interest Rates – Act Now!

The Bank of Canada’s rate cut presents a unique opportunity for buyers, sellers, and homeowners looking to refinance. Don’t miss out on lower mortgage rates and increased market activity—now is the time to make your move!

📞 Call us today at 647.493.3579 to discuss your options.

📧 Email us at [email protected] for expert advice.

🌍 Visit www.tonyledi.com to explore the latest listings.

🏡 Whether you’re buying, selling, or refinancing, our team is here to guide you every step of the way. Let’s make your real estate goals a reality! 🚀

.png)