Sometimes, the simplest moments offer the greatest clarity. A few days ago, while taking a short walk around the neighborhood to clear my mind, I noticed something I hadn’t paid attention to before: the leaves were starting to change color, signaling the arrival of fall. In that moment, I realized how quickly time passes and how important it is to recognize the small, often overlooked changes in our surroundings—and in life.

This reflection got me thinking about the many shifts we’ve seen lately, not just in nature but in the real estate market and the economy as a whole. Just like those changing leaves, the economic landscape is always in motion, and staying attuned to these shifts can offer unexpected opportunities.

A New Financial Landscape: What the Interest Rate Cut Means for You

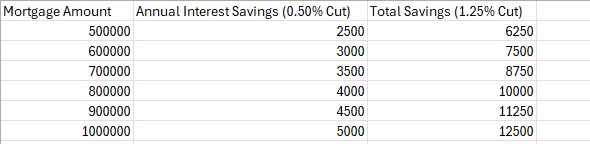

On that note, the Bank of Canada recently made a significant change, reducing interest rates by 0.50 basis points, bringing the total rate cut since June to 1.25%. For anyone carrying variable-rate debt, this is great news—it means lower monthly payments and potentially substantial savings. Let’s break it down:

For example, if you carry $1 million in variable-rate debt, the recent rate cuts could save you up to $12,500 in interest expenses—savings that can be redirected into other areas, from reinvesting in your home to expanding your business.

Understanding how the rate cut affects fixed-rate mortgage holders

For a fixed-rate mortgage, the interest rate stays the same throughout the term of the mortgage. This means that any interest rate cuts by the Bank of Canada wouldn't directly affect the interest payments for borrowers with a fixed-rate mortgage. Borrowers with fixed-rate mortgages would continue to pay the same amount regardless of these rate cuts until their term ends and it's time to renew or refinance.

When the term of a fixed-rate mortgage ends, the borrower may then benefit from the lower interest rates if they choose to renew their mortgage at that time. However, the immediate savings seen in a variable-rate mortgage would not apply to fixed-rate mortgage holders during the term.

If you're considering whether to switch from a fixed-rate to a variable-rate mortgage or vice versa, it depends on your financial goals, risk tolerance, and current market conditions

To calculate savings for a fixed-rate mortgage, you'd typically look at two scenarios:

- Refinancing or Renewing at a Lower Fixed Rate: If you’re approaching the end of your fixed-rate term or planning to refinance, you can calculate savings by comparing the current rate on your mortgage with the new lower rate you could secure.

- Early Payoff Savings: If you're paying off your fixed-rate mortgage early due to refinancing into a lower rate, you can calculate the difference between your current interest payments and the new interest payments over the remaining term.

Here’s how you can calculate potential savings:

Step 1: Calculate your current annual interest payments.

Use the formula: Annual Interest Payments = Mortgage Amount×Current Interest Rate

Step 2: Calculate your new annual interest payments after refinancing:

New Annual Interest Payments=Mortgage Amount×New Interest Rate

Step 3: Determine your savings:

Annual Savings=Current Annual Interest Payments−New Annual Interest Payments

Example:

Let’s say you have a $500,000 mortgage with a fixed rate of 3.5% and you’re refinancing into a new fixed rate of 2.5%.

- Current annual interest payments:

$500,000×0.035=$17,500\$500,000 \times 0.035 = \$17,500$500,000×0.035=$17,500 - New annual interest payments after refinancing:

$500,000×0.025=$12,500\$500,000 \times 0.025 = \$12,500$500,000×0.025=$12,500 - Annual Savings:

$17,500−$12,500=$5,000\$17,500 - \$12,500 = \$5,000$17,500−$12,500=$5,000

So, in this case, refinancing to a lower fixed rate would save you $5,000 per year in interest.

The Importance of Adaptability in Real Estate

In real estate, market conditions can shift quickly, and those who are prepared to adjust their strategies are the ones who thrive. It’s like sailing—when the wind changes, you don’t stay on the same course; you adjust your sails. This adaptability can lead to opportunities that were never part of the original plan but end up being even more rewarding than you could have imagined.

In many ways, this philosophy of being open to change mirrors how Tony and I approach our work in real estate. We focus on anticipating our clients' needs and staying agile in a constantly evolving market. Just like in life, being ready to shift gears can make the difference between just getting by and truly succeeding.

Embracing Change for Long-Term Success

As we move forward, embracing change can be our strongest asset. Whether you're navigating through a busy real estate market or dealing with life's daily surprises, remember that flexibility and resilience are often the keys to turning challenges into new beginnings.

Here’s to finding strength in the unexpected!

Take Action Now: Reap the Benefits of Lower Rates

Now is the time to assess your options and explore the benefits of refinancing or purchasing with lower rates.

At Tony & Ledi, we’re here to guide you through the process and ensure you make the best decision for your financial future.

Special Offer: Free Home Evaluation + Financing Review

https://www.tonyledi.com/homeworth

As a special offer, for a limited time, we’re offering a free home evaluation and financing review. Let’s explore how much you can save with the current rate cuts and whether refinancing or purchasing now makes sense for you. Our team will walk you through your options, providing you with the insights and tools you need to make the right decision.

Don’t miss out on the opportunity to turn these market shifts into your advantage—schedule your free consultation today! https://calendly.com/tony-ledi/15min

Ledi Alushi, Civil Eng, Broker

Your Home Sold Guaranteed or We'll Buy It!*

.png)